Focused Research

Advancing Sustainable Data Center Development in Texas

The Center for Energy Economics (CEE) at the Bureau of Economic Geology, UT Austin, is actively researching and facilitating the sustainable growth of data centers in Texas. Our multidisciplinary approach addresses the complex integration of digital infrastructure with energy, water, and economic systems. Our goal is to guide Texas towards a future of sustainable and economically beneficial digital infrastructure. Click here for more information.

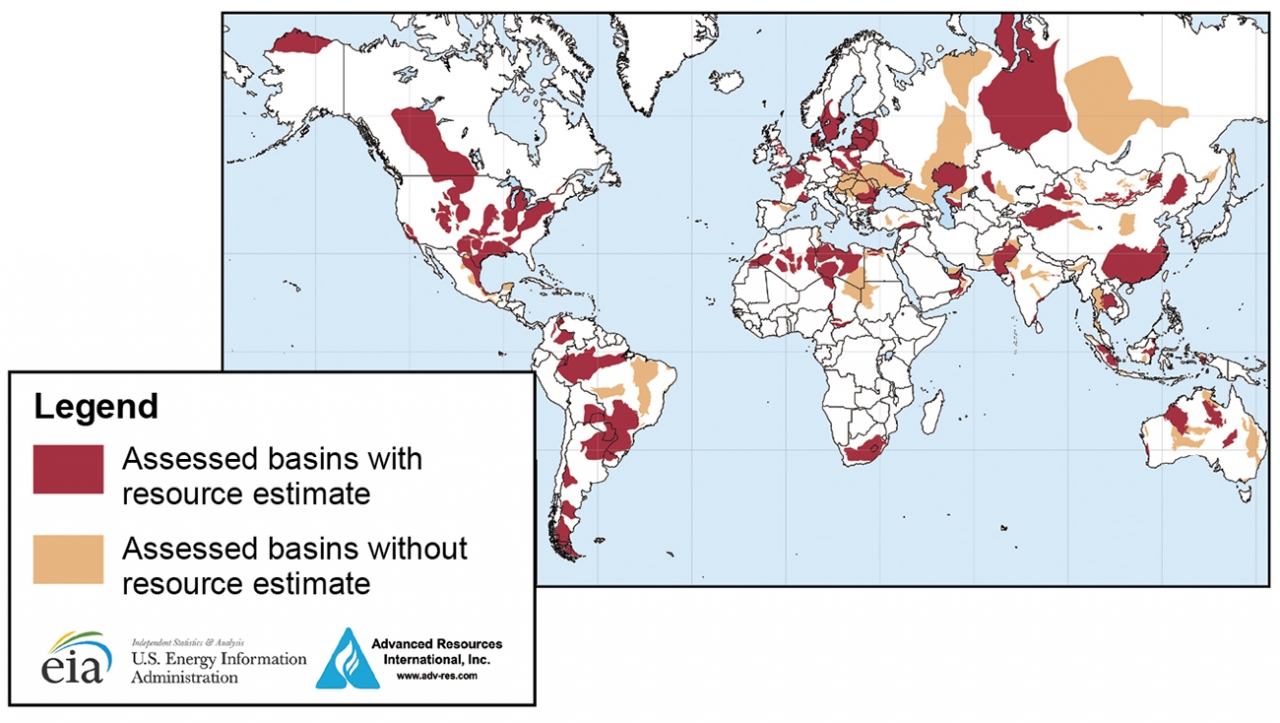

Challenges of Global Unconventional Oil and Gas

We study opportunities and risks in global unconventional resource exploration. Although solid evidence supports international shale potential, development outside of North America has proven difficult due to local challenges. Many countries with shale deposits lack attributes that have made North American shale development successful. These include sufficient high-quality proven reserves based on a fine understanding of a country’s geology; mineral rights in land ownership; a mature exploration and production industry with a deep financial market and talent pool; and established infrastructure and transportation, this set of shared challenges is faced by producers, investors, and local governments. In this study, CEE has identified some critical gaps that it could help to fill.

Click image to view larger.

Recent Presentations and Work

Ning Lin, No Fool's Choice: How Unconventional Shale Development Fit into a Sustainable Energy Future for Emerging Economies, U.S. Association for Energy Economics 2019 conference, Denver, Colorado

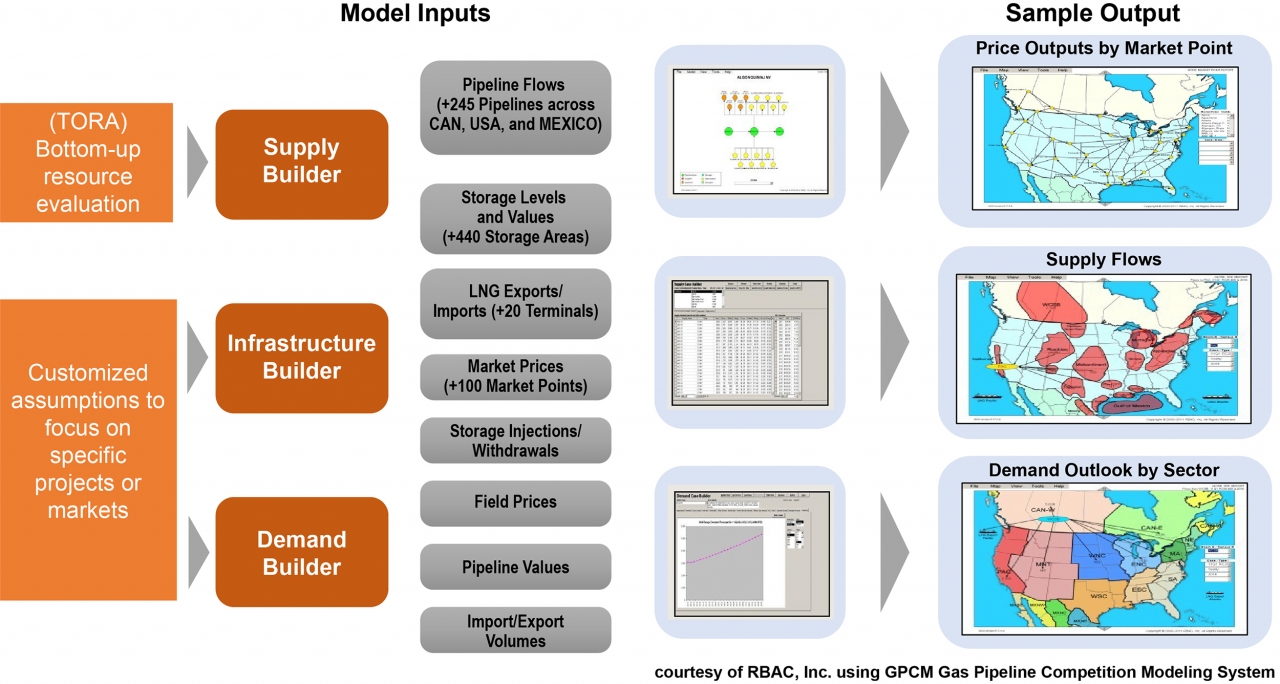

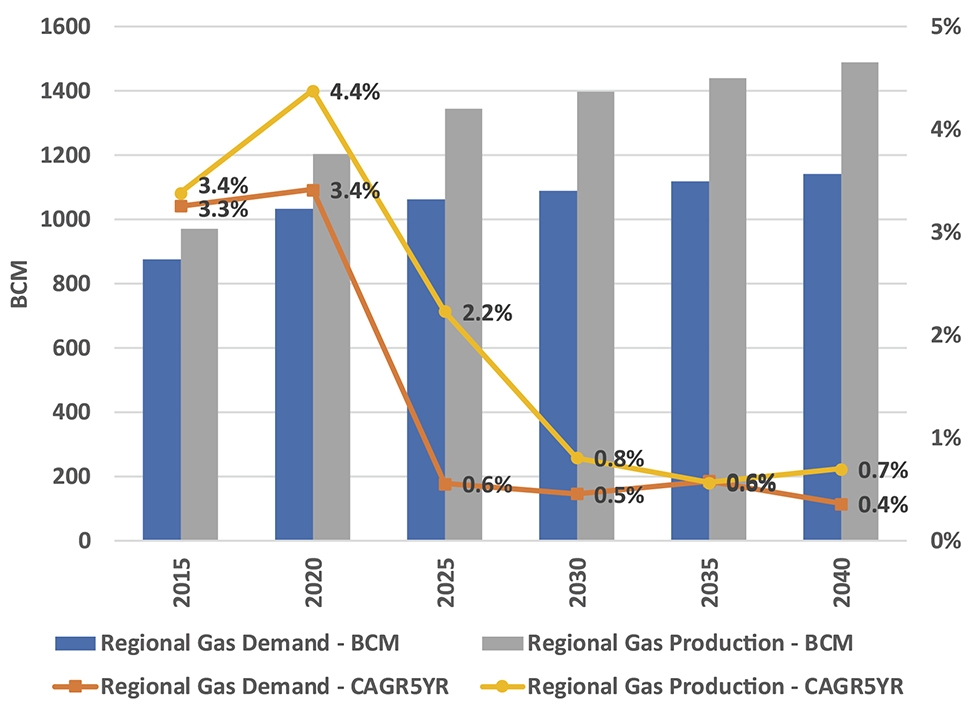

North America and Global Natural Gas Market and Infrastructure Simulator

CEE will extend its upstream geological research in the Permian Basin and other key basins in North America to include value-chain and market analyses. This would transform the technical knowledge of upstream geology and operational technology for production forecast scenarios. It would add to the analyses of robust infrastructure and price-impact sensitivity, which could directly influence the decisions of midstream and downstream oil and gas operators.

North America is the most efficient and connected market for natural gas in the world, where the market price provides clear signals reflecting changes in supply and demand, infrastructure, and storage. This makes fundamental modeling of the North American gas market particularly valuable in decision-making. Analysis begins with an economic modeling system, the Gas Pipeline Competition Model (GPCM®), which covers the entire value-chain setup of the North American gas market, from upstream supplies, to pipeline and storage, to downstream demand areas by segment. Then the proprietary data of upstream production is incorporated and, through this simulation platform, opportunities and strategies can be identified. This allows for the forecasting of sudden market price changes when production becomes out-of-sync with infrastructure, as happened in the Marcellus and Permian gas plays in recent years. It also provides an understanding of what sudden market price changes mean for different players, as in planning for new infrastructure projects for midstream operators, the rethinking of gas procurement strategies for downstream operators, or consideration of decisions for infrastructure needs and future production for upstream players.

CEE Workflow of natural gas market (North America) simulator

CEE Emissions from LNG value chain

Touted as “freedom gas” by the Trump administration, American LNG has quickly turned into a major export commodity for U.S. energy companies. However, as LNG production increases in the U.S., although LNG is a cleaner fuel, there are rising concerns about emissions generated during LNG production from various sources.

As LNG exports become a strategically more important part of the U.S. gas sector, CEE plans to take a closer look at the center of the debate: What is the true emission impact of U.S. LNG exports? This is not a question that can be characterized as either good or bad. It will take a systematic approach, with solid data-driven analysis, factoring in the more advanced technology installations for LNG projects in the Gulf of Mexico region, to put together a complete picture.

Recent Presentations and Work

Ning Lin, Permian Goes Global—How to leverage USA LNG in a changing global market? LNG USA Summit, Houston, Texas, February 2020

The Risks and Opportunities of Power Integration for Oil and Gas

The Tight Oil Resource Assessment (TORA) team integrates geologic and reservoir characterization with well economics and development forecasting to provide a granular and comprehensive outlook of oil and gas production. The extent of TORA assessment can be divided into original resource in place (original gas and oil in place); technically recoverable resources utilizing current and likely future technologies; economically recoverable resources given specific technology and economic assumptions; and short-term and long-term production outlooks under various energy prices, costs, technology, and regulations.

Oil and gas activities are an active and important contributor to load generation for local utilities and grid operators, while electricity cost is also one of the most important cost factors in production of oil and gas. Hence it is paramount to explicitly link upstream activities into electric load and transmission needs.

This research extends the research from the Tight Oil Resource Assessment to fit the needs and priorities of the power sector and provides a customized knowledge base to translate upstream activities and science into relevant load and infrastructure impacts for local utilities in a given service area.

The initial scope of the study focuses on the Permian Basin while the team is working on extending to other major unconventional basins in the U.S., for a location-based estimate of load and infrastructure impact of oil and gas and to further build a shared understanding of power-integration needs. A reliable transmission grid has proven to be a critical factor for energy security and resilience, especially through the recent pandemic. Oil and gas upstream are a major demand sector in producing basins for local power operators and utilities. Due to frequent market volatility and changes in investment environment, it is important to factor in a range of possibilities for load demand and future transmission needs for the power sector, and to exploit opportunities to combine renewable and inexpensive fossil fuel for a low-cost and reliable power system.

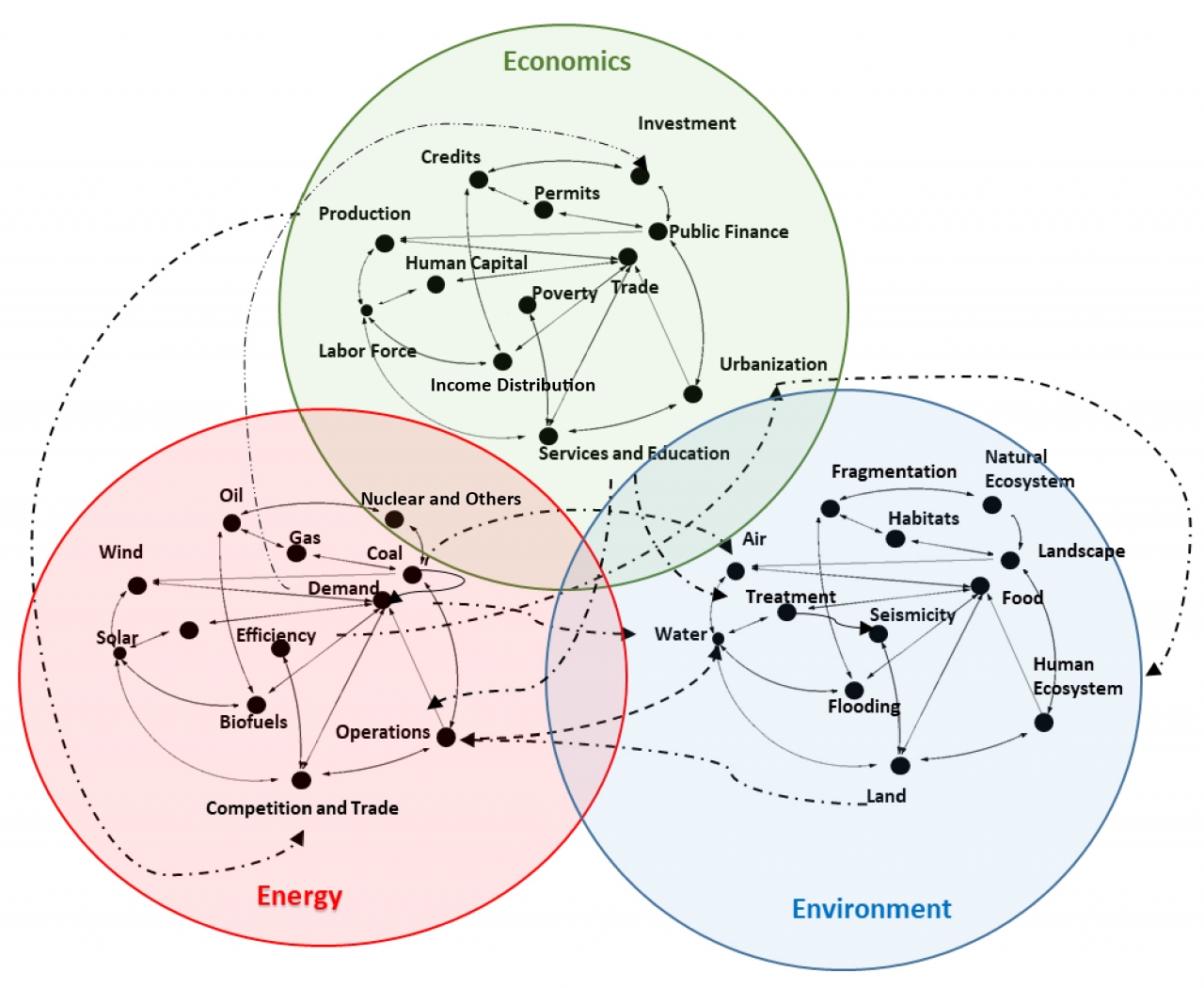

A Pathfinder for Sustainable Energy Transition in Texas

Instead of looking at sector-specific questions and decisions, CEE is working with a team across The University of Texas at Austin campus to establish a framework to facilitate effective decision-making for energy technology and policy that will enable a sustainable energy transition in the state of Texas. Sustainability implies reliable and affordable access to basic but interrelated resources—energy, water, food, and land—to meet the state’s current requirements without compromising the ability of future generations. The recent news about California’s Pacific Gas & Electric Company (PG&E) provides an illustration of how these resources are interrelated. PG&E shut down power through 800,000 connections in 34 California counties to avoid the threat of wildfire from outdated infrastructure within the electric grid. For a 48-hour blackout period, up to $2 billion in damage occurred for customers, in addition to further impacts to the whole community and the area’s economy.

This series of events highlights the importance of making effective decisions on these four basic resources; any change in one sends immediate and cascading impacts through all systems.

The concept is to take the lessons from California and apply them to Texas in order to establish a framework facilitating effective decision-making on energy technology and policy.

Access to Water and Energy Research Consortium

Understanding the energy and water resources available to provide sustainable and economical options to decrease energy and water poverty. Options considered are geography specific, tailored to communities in developing countries.