Center For Energy Economics

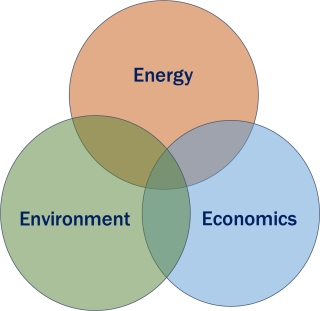

Energy economics research at the Bureau of Economic Geology seeks an understanding of relationships among energy resources and generation, economics, and the environment. The research aims to establish a solution-based platform to help stakeholders make well-informed decisions at each of these related nexuses.

Center for Energy Economics (CEE) research is practical; it improves consensus decision-making and outcome predictability among energy and economics stakeholders. Research is organized around the CEE and is conducted collaboratively with member organizations and companies as well as other Bureau research consortia.

Mission

- Provide impactful and data-driven analyses of environmental, economic, and energy issues, with a sharp focus and broad perspective

- Enable government, industry, and independent stakeholders to seek actionable and innovative solutions by leveraging cross-discipline expertise

- Build a solid knowledge system of U.S. and global energy fundamentals to serve as a necessary foundation for collaborations

Research Thrusts

The Center for Energy Economics is working to make an impact by leveraging expertise in geoscience resources, environmental considerations, and economics to address the energy and environmental challenges shared by industry and communities today. Accurate characterization of relationships among energy production, electricity generation, and economic and environmental effects holds great potential for improving outcomes for energy producers, local and regional economies, and citizens.

Bureau and consortium-member data, as well as recent advances in modeling and software user experience, enable the transformation of available data into a practical, widely adopted tool for consensus decision-making. CEE work can currently be categorized into three research thrusts:

Extend existing expertise to align with market needs

Leverage existing upstream and subsurface scientific research and extend into new impactful areas of research tying geology and resource to market and economics

- Investigate the opportunities and risks of global unconventional resources

- Vertical integrated value chain market analysis for North America and global natural gas market and infrastructure: from Gulf of Mexico gas to global liquefied natural gas (LNG)

- Forecast load generating needs in oil and gas producing regions, and maximize synergy between oil and gas activities, power transmission, and local generation planning

Promote taking a systems-thinking approach

Study applied economic analysis of environmental and energy choices, and complete scientific research with better economic thinking through cross-disciplinary collaboration

- Become a pathfinder for sustainable choices in policy and technology, showing the way to balance the energy transition to lower carbon sources and economic resilience in Texas.

- Research the technology and policy choices involved in flaring—a case study in the Permian Basin

- Access to water and energy