CEE Looks to the Future of U.S. Electricity Market Economics

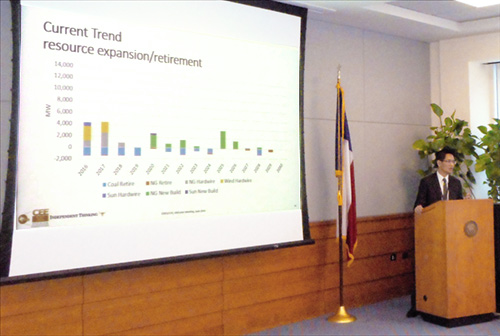

Dr. Chen-Hao Tsai presents his research findings during CEE's Mid-Year Meeting.

The Bureau’s Center for Energy Economics (CEE), world-renowned for its research into issues related to oil and gas markets and their economic impacts, is historically even more strongly rooted in the complex world of electricity markets in the United States, especially in Texas. CEE’s recent Mid-Year Meeting, held at its offices in Houston, showcased the group’s electric-power research portfolio for a large group of the Center’s donors, advisors, and other invited guests (consultants, economists, and financial analysts) and featured spirited discussion of expectations, uncertainties, and predictions related to U.S. electricity markets.

A vast number of variables influence how electricity markets behave and what they might do in the future. For example, the increased utilization of power generated by wind and solar installations—built mostly with the help of tax credits and long-term contracts by utilities—and how that power is accessed by consumers (for example, rooftop solar versus central solar farms) has caused utilities to rethink traditional pricing structures. Along with demand growth uncertainty and low natural-gas prices, low-cost renewables generation has also raised challenges for merchant generators in competitive markets. On the other hand, solar and wind projects require economic consideration of how to provide baseload power—conventionally provided by coal, natural gas, or nuclear plants—to address their intermittency. Gas is often seen as necessary to balance variable wind and solar generation, but such utilization of gas units may not generate revenues sufficient for commercial viability.

From left to right: CEE Senior Energy Economist Gürcan Gülen, guest speaker Marc Spitzer of Steptoe & Johnson, LLP, CEE Senior Energy Economist Michelle Michot Foss, and CEE Senior Energy Economist Chen-Hao Tsai.

Another variable for consideration is the rapid decline of coal and ascendancy of natural gas as the major power-generation resource in America. Premature nuclear retirements further complicate competitive market designs, reliability considerations, and achievement of greenhouse emissions goals. CEE’s dispatch modeling implies gas burn for power generation to increase from about 9.5 trillion cubic feet (Tcf) in 2015 to 13–15 Tcf by the middle of the 2020s, depending on the scenario.

Questions about markets abound. How will consumers, both wholesale and retail, pay for flicking on the light switch in the future and, further, provide enough revenue to electric companies to warrant investment in new power facilities to serve increasing loads? Will loads continue to increase? Will distributed resources and demand response change the game? What impact will increased gas use for power generation have on natural-gas prices and deliverability? Will nuclear power use grow in the future, especially in the wake of the Fukushima disaster and cost challenges? What will government subsidies for energy look like in the future?

“We devote a great deal of time to thinking about and researching these complex electricity markets, and we appreciate the thoughtful input we received from our colleagues at the Mid-Year Meeting,” said Gürcan Gülen, CEE research scientist and senior energy economist. “Our objective is to allow our research in this area to guide the decision makers and stakeholders of the electricity sector as they consider the many economic factors affecting the industry.”