Lithium and Mineral Resources from Brines

As energy applications shift toward lower carbon-footprint, renewable, alternative energy sources, the demand for battery materials that hinge on more efficient battery chemistry will increase. Our analysis indicates that 75% utilization rates at existing production capacity coupled with upcoming projects can satisfy most of the expected demand for both lithium and cobalt in the short run. However, high‐growth scenarios require new capacity and/or significantly higher rates of utilization in existing facilities. The influence of geopolitical risks, growth in other applications, and development of new applications could push demand in excess of production capacity. Government regulations in response to local interests, environmental concerns and future sustainability have influenced material supply in the past and may continue. While many factors could ease pressure for new production capacity, development of new applications like grid energy storage and use of lithium‐ion batteries in heavy vehicles have the potential to significantly increase demand beyond what is typically expected in the literature.

It is widely believed that if there is enough economic stimulus for lithium and, due to increasing demand, new production capacity will be built. Any lithium brine production mine in South America requires a minimum of 4 years to come online from the point of inception and can require another 3 to 4 years to reach full capacity. Similar permitting and construction timelines exist in Australia, Canada, and other parts of the world where new lithium projects are being developed. Besides the vast resources proven today, new resources like oil field brines, hectorite clay, and jadarite are being actively pursued. The critical factor, however, is that of production capacity. Targets for electric vehicle deployment and energy storage applications are ambitious and need to be met sooner than much of lithium mining capacity will be built. The Economic Minerals Program has initiated research with CEE on the interplay between lithium resources and energy value chain applications (see references). Investigations include supply-demand drivers, resource recovery costs, supply chains and logistics and trade flows. Research will be expanded to incorporate critical minerals that are used in concert with lithium for lithium-based energy storage (battery) designs. CEE’s own research provides short and long term market signals for energy end uses, ranging from shifts in the U.S. and global vehicle fleets for transportation and electric power system transitions that may require energy storage solutions and advances.

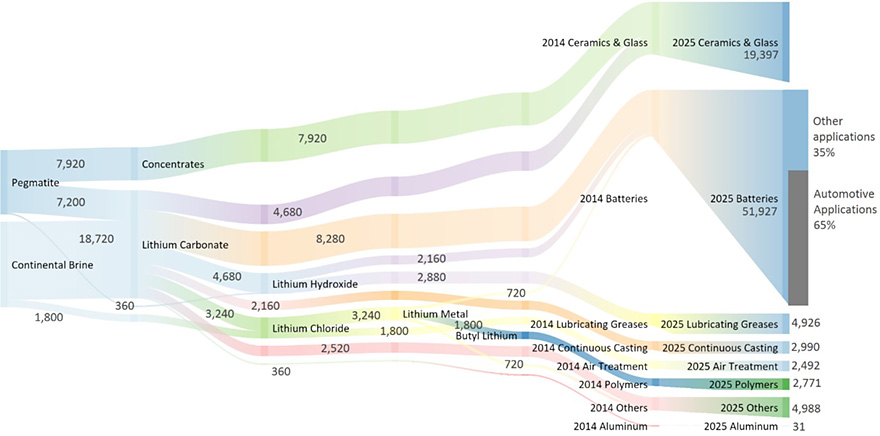

Lithium flow diagram from source type to end use.

Main Areas of Research Interest

Upstream deep dives

- Develop an in-depth understanding of the lithium resources: geology, deposition, chemical formation, and extraction procedures

- Develop an in-depth understanding of the lithium market: end users, types of chemical compounds, applications

- Build upstream supply (value) chain model for global lithium supply: catalog resources, reserves, production facilities, processing plants, country specific commercial frameworks, and industrial frame works

The economics of minerals extraction

- Develop an understanding of supply-demand drivers

- Identify and model materials locations, how minerals resources are captured, global value chains from extraction to manufacturing end use

- Identify and resolve potential bottlenecks, trade issues and other potential risks to value chain integrity

- Research dependence of extraction of lithium on other materials like potash

- Identify and model manufacturing locations for batteries and alternative energy system components and implications for supply of raw material on manufacturing and implications for supply of manufactured components on global deployment

Measure criticality

- Assess criticality of lithium for manufacturing applications focusing on lithium ion batteries for electric vehicles and other energy storage applications

- Calculate criticality based on production growth, impact of manufacturers, market response to supply gluts, possibilities of substitution, geo-political risk at host countries, and other factors using CEE and National Science and Technology Council’s methodology

- Develop trade flow maps, identify potential bottlenecks, and calculate impact on renewable energy deployment

Prospects for recycling and substitution

- Survey of literature and projects to assess possibilities of substitution and recycling of lithium products

- Identification of areas of further research needed to develop recycling efforts

References

CEE_Research_Note-Battery_Materials_Value_Chain-Apr16.pdf Manuscripts in process.

CEE Research Snapshot (2015). Battery Materials Supply Chains, CEE_Snapshot-Battery_Materials-Nov15.pdf

Verma, R., Foss, M. M., Gülen, S. G., Tsai, C.-H., Quijano, D., and Elliott, B., 2016, Battery Materials Value Chains, working paper.