At the Bureau’s Center for Energy Economics (CEE), our research on upstream oil and gas economics incorporates ongoing analysis and monitoring of operating companies. Our samples include companies based in, or with operating subsidiaries in, the United States that have a presence in the major unconventional plays; large integrated international oil companies (IOC’s) that invest in large-scale development projects upstream and downstream; and integrated national oil companies (NOC’s)—some operating outside of their home countries—that have varying degrees of access to global capital markets, either through traded shares and/or debt.

We undertake this research effort to better understand the opportunities and challenges associated with oil and gas exploration and production in the United States and worldwide. A number of important research themes and questions permeate our analysis:

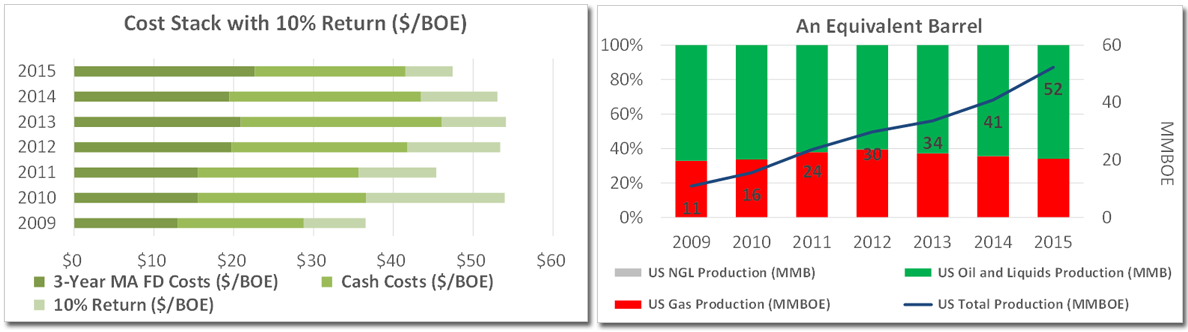

- Given the rapid acceleration of shale oil and gas plays and activity in the United States and Canada, a key interest is in bridging the gaps between single-well screening economics and the complexities of building and sustaining corporate portfolios of acreage positions, with drilling and exploitation across numerous unconventional and conventional plays and locations. We use a full-cycle cost approach and company financial reports to capture the upstream cycle. We calculate finding and development capital expenditures and associated changes to company reported reserves (on a rolling 3-year average basis). Our estimates of cash (undepreciated) annual costs incorporate all requirements to produce oil and gas, cover lease-operating expenses, engage in any transportation and marketing required to monetize production, and cover other obligations such as production and income taxes and interest on debt. The results of our work demonstrate more accurately the cost of U.S. onshore oil-and-gas supply attainment and sensitivity to commodity prices.

- A second objective is to better understand, at the company level, the prevailing trends in oil and gas production that are evident in U.S. aggregate data, in particular from tight rock plays. The nature of these plays is such that production streams are inevitably “lighter,” with companies delivering very light oil, natural-gas liquids, and methane as the dominant streams. The challenges of sustaining values for these production streams—given the large volumes needed to amortize cost and, in lower-price environments, achieve operating cash flows—has impacted company strategies and triggered deep adjustments in the U.S. midstream segment. (CEE researchers engage in related research on midstream sector developments and on downstream monetization and use of U.S. oil and gas production.) Even the “oiliest” operating companies, those that deliver barrels equivalent to light sweet crude oil, maintain production splits that contain significant portions of natural gas—a dominant feature of the U.S. oil and gas landscape today and one likely to be found in international locations where unconventional plays are pursued, adding to the complexity of building shale oil and gas production abroad.

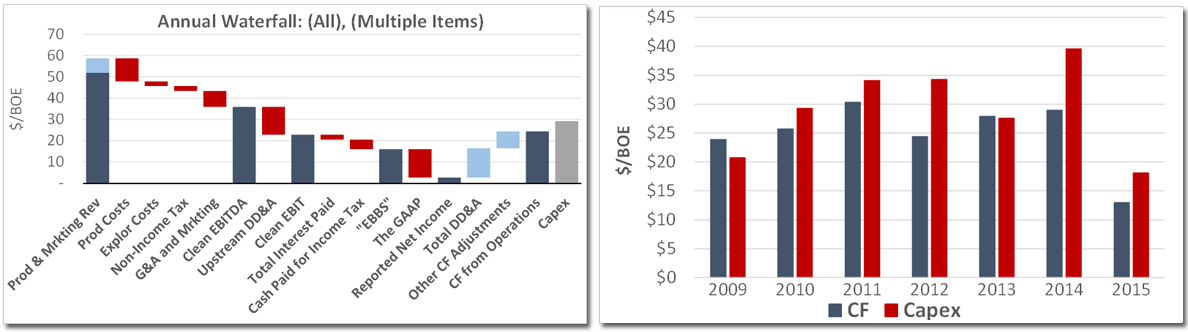

- A third key research objective is to analyze sustainability of U.S. domestic production, principally onshore, to varying commodity price and market assumptions and scenarios. Unconventional opportunities have been favored as alternatives to the exploration risk typically associated with conventional wells and fields, where initial “wildcat” drilling is required to determine whether hydrocarbons are present in commercial quantities. In unconventional, or resource, plays the targets are source rocks underlying conventional production. The challenge in resource plays is adequate recovery of original volumes in place at favorable “realized” prices—what companies actually are paid for production sold—to recoup costs and provide returns. Capital requirements of unconventional plays are intense, making them quite sensitive to commodity prices. Even during the times of favorable prices, producers are hard pressed to generate sufficient operating-cash-flow coverage for capital expenditures. Alternatively, producers must try to scale up production in order to make up the difference during periods when prices are lower. The trend over time illustrates the demands on companies as they work to stay ahead. Overall, not only for our sample of 16 companies operating in the United States but also for much larger samples used by other research groups, the U.S. domestic industry has struggled to generate operating cash flows that exceed annual capital expenditures, which adds to stress during times of downward price pressure and means that companies must be able to continue to tap into external capital markets.

Capital-market participants—banks, equity funds, and other sources, including global entities—already have been strongly attracted to the U.S. unconventionals scene. The health and resilience of the U.S. domestic industry would be strongly advantaged if both public and private companies were better able to generate enduring positive-cash-flow positions. We observe the same trends and pressures among IOC’s and NOC’s. Ancillary to our core-producer benchmarking analysis are investigations into how producer finance is changing overall, including the impact of price-risk management (hedging to protect cash flows). These efforts are yielding numerous insights into future U.S. and global supply risks and uncertainties, as well as fascinating clues as to the role of producer finance in opening up new opportunities for hydrocarbon exploitation.

Combined Cash Flow Waterfall, 2009–2015, for CEE Sample of 16 Companies and Long-Term Trend in Cash Flow (CF) to Capital Expenditure (Capex)

CEE’s efforts and results are yielding insights to BEG’s resource assessment research teams. Our observations and accumulating knowledge base are helping us to better understand the structure of the oil and gas upstream industry in the United States and worldwide, informing our views and research on oil and gas supply/demand balances and associated economic considerations. As our work filters into the public domain, it is helping both companies and their investors to better understand the upstream cycle and the broader oil-and-gas-industry value chains and critical linkages. Policy makers also are accessing CEE research in order to better understand the nature of oil-and-gas commodity cycles and investment requirements, to draw lessons from the U.S. unconventional plays, and to gain insights that are essential for more-reliable outlooks of future oil and gas supply.

Project Summary

Name of Project: Upstream Economics Research—Producer Benchmarking

Name of Research Program or IA: Center for Energy Economics

Date of Project Start (if applicable): Ongoing

Term of Project (if applicable): Ongoing

Project PI(s): Michelle Michot Foss

Other Key Personnel: Miranda Wainberg, Daniel Quijano, Deniese Palmer-Huggins

Principal Information Contact: Ning Lin, Chief Energy Economist and Program Manager

Funding Source(s): CEE research donors, STARR-EE

Other Key (Institutional or Business) Partners/Collaborators: CEE advisors and donors

Geographic Area(s) of Study: U.S. and worldwide domestic oil and gas exploration and production

General Discipline of Study: Financial data analysis to support

Keywords: unconventional and conventional oil and gas production, acreage portfolio, full-cycle cost, cash flow waterfall, capital expenditures